Historically, financial advisors have tended to think of clients in two broad categories: do-it-yourselfers (DIY) and delegators. Before you write off the DIY types, think about how they could become a client one day who appreciates professional advice.

General Characteristics of DIY Investors

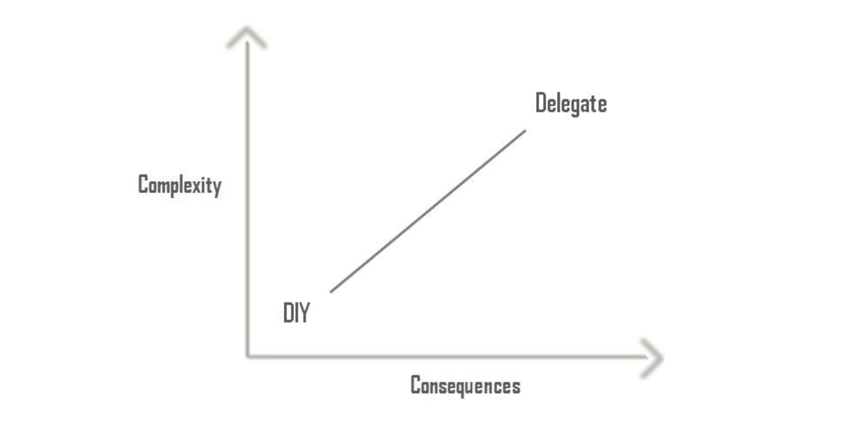

Many investors are comfortable with a DIY approach when they are younger and still in early wealth accumulation mode. At this stage, they often feel (rightly or wrongly) as if their situations are sufficiently straightforward and therefore don’t think they need the help of a wealth advisor. However, as individuals’ financial complexity increases and stakes become higher, they are much more likely to delegate to a wealth advisor.

In addition, younger investors are likely more price sensitive about wealth advice because they may not believe there are consequences to not having an advisor and may think their finances aren’t complicated enough to warrant hiring an advisor.

Business Owners Seeking Advice

It is not uncommon for business owners, who normally don’t work with a financial advisor, to seek out professional advice when approaching a transition. For example, they may need advice when selling a business, which triggers a liquidity event and in turn the need for advice on how to invest that money.

Life Events Can Trigger the Need for Advice

If a prospect is experiencing a significant life event, they will likely answer “yes” to the questions below and may decide to seek financial advice. Such life events include divorce, retirement, job loss and dealing with the loss of a spouse.

DIY or Delegator? Find Out With These Questions

Here are three simple questions to ask a prospective client to help you determine if they are a DIY or delegator:

- Does my financial situation seem overwhelming to me when I think of all the different aspects I need to consider?

- Are the consequences of making a mistake potentially very high?

- Do I have the knowledge and skills needed to do it right?

Cultivating Relationships

In your daily life, when you come across a DIY investor, open a dialogue to learn more about why they prefer to be self-directed and use it as an opportunity to share the long-term benefits of professional wealth advice.

This material is intended for informational and educational purposes only. No representations or warranties, either express or implied, are made regarding the accuracy or completeness of the information contained herein. Reliance upon information in this material is at the reader’s sole discretion.

Mariner Advisor Network is a brand utilized by Mariner Independent Advisor Network (“MIAN”) and Mariner Platform Solutions (“MPS”). Investment advisory services are offered through Investment Adviser Representatives registered with MIAN or MPS, each an SEC registered investment adviser. For additional information about MIAN or MPS, including fees and services, please contact MIAN /MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov).

For Investment Professional use only. Not for use with the public.